Building a nest-egg?

Written: 12 August 2022

Author: Kirsty O’Hara

5 min read

Review your investment strategy with 6 rules and tools.

This blog is shared out of goodwill with the sole purpose of providing guidance and education around investment literacy. Flint is not affiliated with Sorted in any way. Regarding the investor profiler tools, Sorted comment: these investment mixes are only a general guideline, and your ideal mix will change over time as your needs and goals change.

Sorted state that “investing is when we buy things that put money back into our pockets”.

Regardless of how deep your pockets are, or where you are at in your investing journey, you’re going to hear the terms: time horizon, investor profile (or investor type), risk profile and risk tolerance. Sorted, part of Te Ara Ahunga Ora (New Zealand’s Retirement Commission), want New Zealander’s to truly understand how timeframes, money mindsets, and attitudes to risk matter when it comes to selecting investments.

They champion the ethos that: “The way to start investing is to learn some basics and give it a go. Now we’re not encouraging everyone to take too many risks (no sense losing sleep over this), but investing can help your money keep growing so you get something back into your pocket.”

Sorted strive to demystify stigmas that you need to be wealthy already to consider investments. They instead encourage an adoption of forecasting tools to provide insights and inspiration to refine money habits. If you missed our article “Let’s demystify Money, with Sorted” you may like to check it out here. It gives an overview of who Sorted are and the different financial calculators and tools you can explore as part of Sorted’s annual Money Week.

Regardless of your age and stage, we invite you to tinker with the Sorted investor tools and use them to your advantage – to navigate and understand how to best select the right investments for you. A good place to start is with some timeless rules that can steer us in the right direction.

Rules for investing

Sorted advocate the following rules, as essential guideposts when investing:

Rule 1) Set clear goals: Be clear and realistic about what you want to achieve within your specific timeframe.

Rule 2) Find the right balance between risk and return. Assess how much risk you are willing to take on, and if it is worth the potential returns.

Rule 3) Learn your asset mix. We talk to this further down this article, but in a nutshell – understand what mix of investments suits your investor type. Eg. Shares, Cash, Property, Bonds

Rule 4) Diversify! Spread risk across investments, companies and providers. See our section on eggs below, where we talk more about this.

Rule 5) Do your research. Compare and review options. We share a list of questions below that you may like to consider when researching investment providers. If you’re not sure, it can be worth talking to a financial adviser.

Rule 6) Focus on long-term growth! Growing and compounding your investments over time is the way to go. Staying focused on the long term can help you avoid doomscrolling (explained below).

… And if Flint could add a 7th tool, it would be to adopt a growth mindset and make the most of these forecasting tools - so you enter investments feeling informed. Sorted’s Investor Profiler tools make items 1,2 and 3 easy to consider:

Investor profiles (tick 1,2,3)

The new Sorted investor profiler tool shares indicative ‘timeframes’, ‘returns’ ranges, and ‘chance of loss’ for each of the five key investor profiles. This helps us answer the question ‘how much risk can I realistically handle?’

It also identifies three key mindsets, unique to each of the different risk profiles - which may be helpful to ensure your money mindset does in fact marry well with investments you might be considering. Sometimes people have the timeframe to handle a risky investment, but emotionally are not prepared for the rollercoaster (even if their rational brain is saying ‘it’s all going to be ok in the long run’).

This article summarises helpful insights we gathered from the Sorted investment tools:

Review your investor type?

Sorted give you two options. You can ‘Get started’ and take a short two minute quiz; or you can ‘skip to all investor types’. If you go down the investor profiler route, you get the opportunity to clarify seven key investor areas (via multi-choice format):

- What’s the most important thing to you when investing?

- Why are you investing?

- When do you want to use the money you are investing?

- How would you feel if you experienced a loss during your first year of an investment?

- What are your current levels of debt?

- If you experienced loss of day-to-day income, what would that look like … ?

- What level of security do you feel around your income?

You can give it a go for yourself here.

From answering these 7 questions, you will be directed towards an indicative risk profile (based on your answers).

Investor Profiles

- Aggressive

- Growth

- Balanced

- Conservative

- Defensive

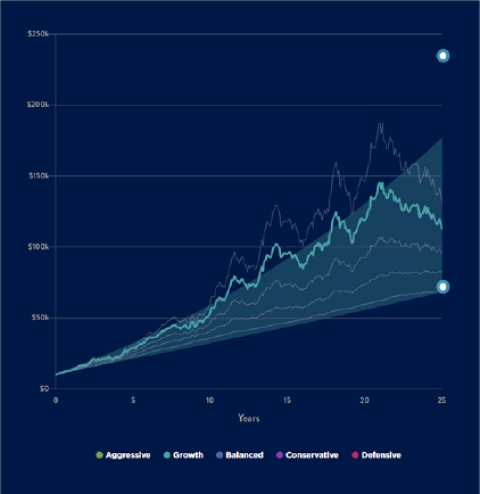

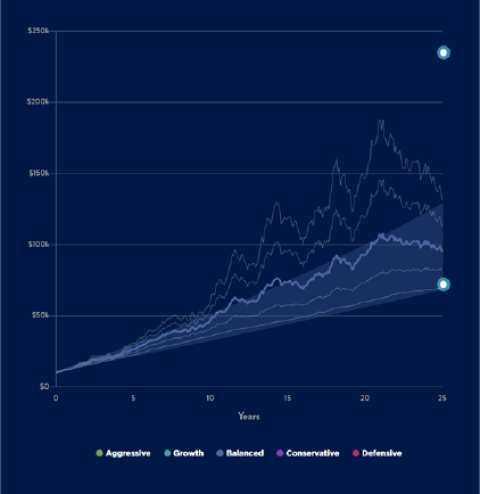

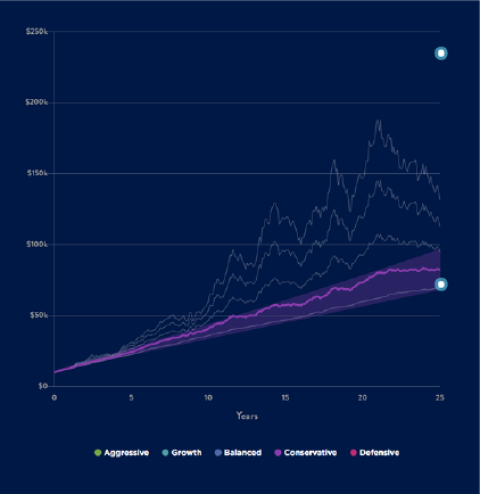

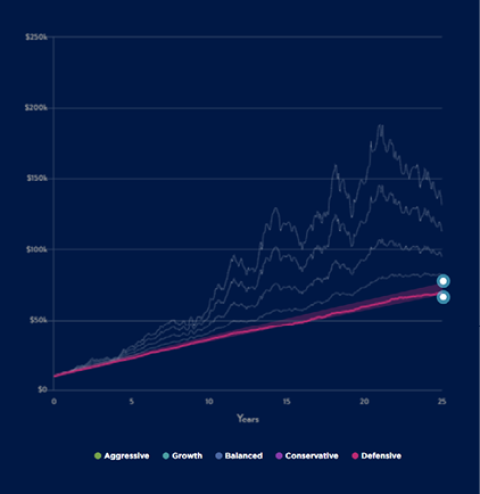

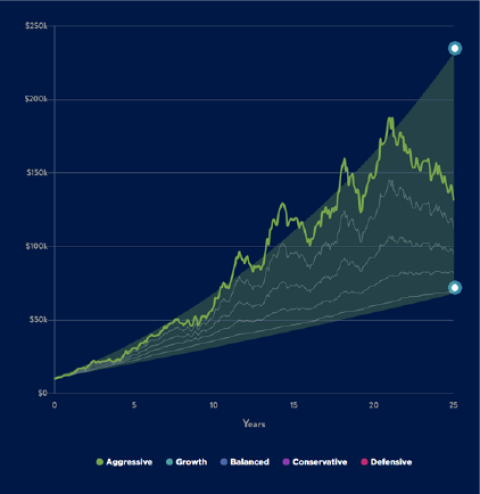

Sorted kindly provide the following indicative timeline charts

AGGRESSIVE over 25 years:

GROWTH over 25 years:

CONSERVATIVE over 25 years:

CONSERVATIVE over 25 years:

DEFENSIVE over 25 years:

Key Out-takes:

Aside from identifying a risk profile and investor type, a pleasant surprise when engaging with these tools is the insightful commentary and observations you may observe when participating. Our key takeaways were:

TIME MATTERS: The younger you are to make investing a priority, the more time you have to benefit from compounding benefits. Additionally, when you don’t need to use the money you are investing for 10+ years, it means you have more time to bounce back from any market volatility – compared with someone who may need the money in the next 5 years, and may possibly lean towards considering more conservative investment options.

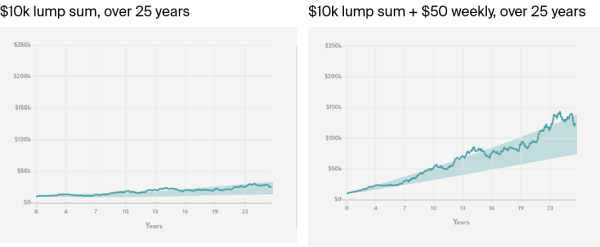

CONSIDER DOLLAR COST AVERAGING: Sorted suggest that: “Steady investing makes a massive difference. Contributing regularly over time (dollar-cost averaging) is a way to get better results. When markets are up and investments are more pricey, the dollars you put in buy less. But when they’re down and investments are on sale, your money buys more. And it takes the guesswork out of deciding when to invest.”

They also suggest adopting the mindset that “we’re buying productive assets whose value can go up and down. The key is to have a long-term plan in place and stick to it. And when markets are down, you’ll be buying assets that are on sale”.

EXPECT SOME UPS & DOWNS (especially if considering growth or aggressive investments): Sorted’s commentary may help to prepare your expectations around what to expect, based on your risk profile. For example: if you identify as an aggressive investor, with a 15 year time horizon, you may find it reassuring to prepare your expectations that 1 in 4 years may not show a good return. Just knowing that an aggressive investment, held over 16 years, may experience 4 years with a negative return may be valuable intel to make the rollercoaster of emotions less of a ride.

ADDING TO INVESTMENTS IS A NO-BRAINER: Sorted use the example that if you invested a lump sum of $10,000 for 25 years and added $50 per week, it transforms the 25 year success window for this investment. While this is not a crystal ball, it is a hugely motivating toggle graph to decide if you want to tighten up your budget and consider an auto-investment option from your regular payday. See the difference for yourselves:

Note: the above examples are for the ‘growth’ investor option. If you run the same scenario for aggressive, balanced, conservative, or defensive then you obviously get a different graph. The key message here is that contributing small amounts, regularly, can transform the curve on this graph. You can click here to give the calculator a whirl for yourself, and observe the difference for every investor profile.

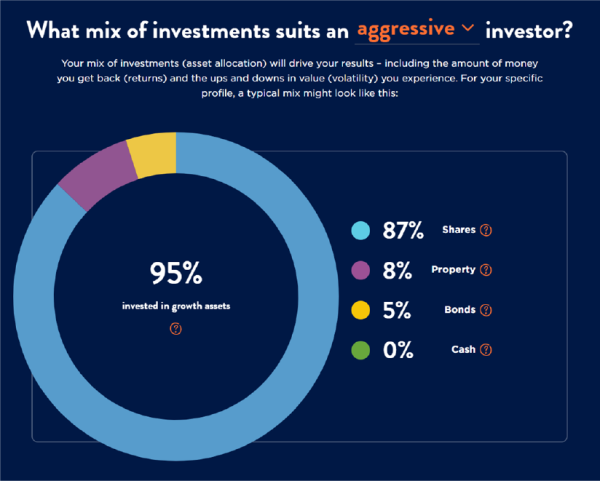

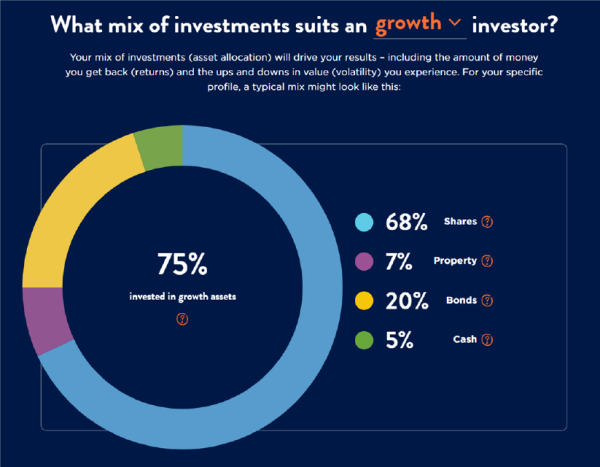

ASSET ALLOCATION SHOULD CHANGE OVER TIME:

In the early days you may choose to set and forget, with regular payday contributions to investments you have selected as part of a bigger picture plan. However as time unfolds, and the time horizon between now and when you need to use this money gets closer, it is super important to consider the composition of your portfolio - so you can tweak and adjust it in alignment with your age and stage.

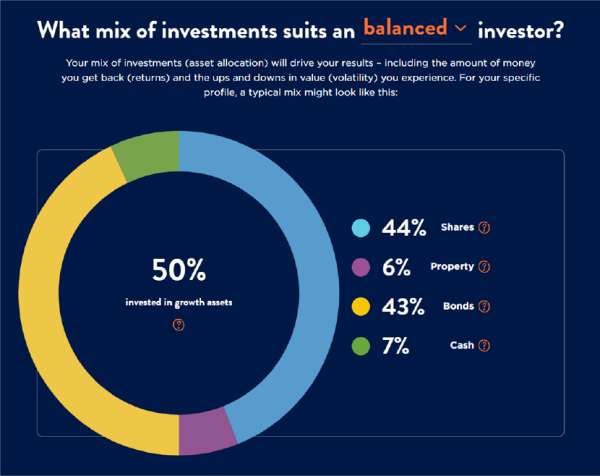

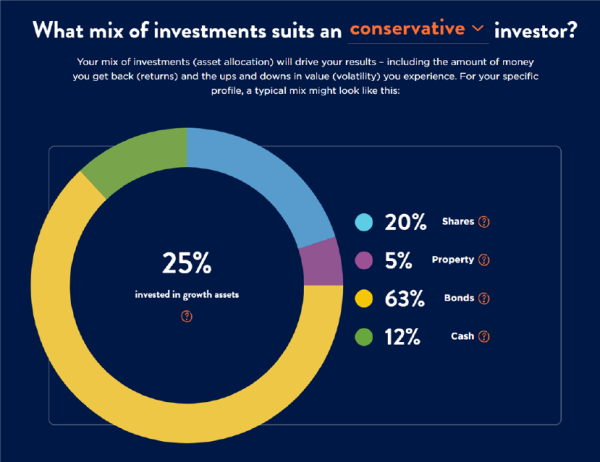

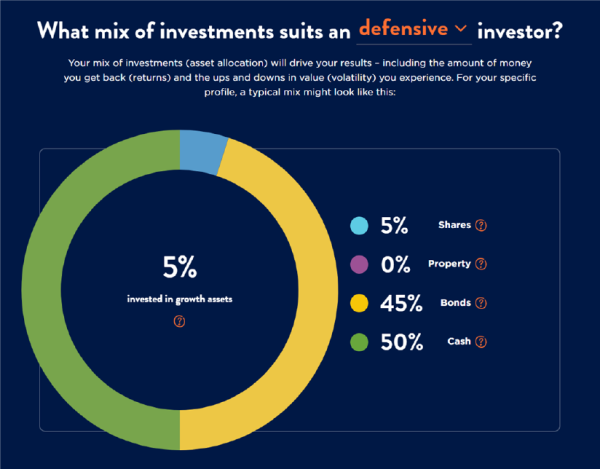

To illustrate this point, we commend Sorted on their stylish pie charts:

Asset Allocation Demo

The biggest difference between these different risk profiles, is a slightly different weighting across the different asset classes. This is illustrated with the Sorted dashboards. We invite you to consider the asset splits Sorted suggest, depending on your investor profile type:

These graphs each include a note: “Within each kind of investment (asset class), it’s a good idea to spread your risk (diversify) across a variety of companies, industries and countries in order to smooth out the ups and downs. Some might not do so well, while others might do quite well – so it’s safer to diversify and not have all your eggs in one basket.”

Smart eggs

Given there are no such things as ‘golden eggs’, we all want ‘nest-eggs’, and we need to ensure our ‘eggs aren’t all in one basket’ – we applaud everyone who is willing to seek information and tinker in the Sorted calculators.

If you’re thinking ‘man, I need more eggs and fast’ and you’re just wondering how to make that happen - then we applaud you for making the most of Sorted’s online tools. While the Sorted calculators are no substitute for a crystal ball, they are a million times better than avoiding financial conversations to later find your future basket is egg-less due to a lack of planning.

Sorted share the following commentary around the importance of rule #4 - diversifying:

“Investing in a single company can have a sad or happy ending. Some of the world’s richest have made fortunes on a single company – a rare unicorn if you will – others have had their investments end up worthless. This is where diversification is the answer – the strategy of spreading the risk that comes with investing in shares over wide geographic areas and industries. And the good news is it’s relatively easy to diversify when we’re investing in fractionalised shares (many tiny slivers of slices of shares). Managed funds often diversify well. (This applies to our KiwiSaver funds, too.) You basically are as diversified as the number of companies included in a given fund. We just need to make sure they are spread out in different industries and locations around the world.”

The theory Sorted support is that “On the whole, if you spread your risk, your investments will be able to weather many storms in the long run.”

One way to ensure a diversified portfolio is to head over to the Sorted Smart Investor. This gallery of fund offerings can match you with investments suitable for your investor profile. It also hosts holdings lists for the companies each fund invests in. A browse of these holding lists can be worthwhile to ensure the funds you are considering will in fact provide you with a diversified mix of investments.

Research

Like all things in life, homework pays off. No different than choosing an accountant, lawyer, bank, adviser or other professional – some due diligence and snooping is worthwhile to find fund managers and investments that are the best fit for your values, time horizon, and financial goals.

Some questions you may like to consider when conducting research include (but are not limited to):

- What does the company do?

- What markets is the company in?

- Who is running the company?

- Have they ever been declared bankrupt?

- Are they on the Financial Markets Authority's warning list?

- How is the company run? What is their framework?

- Does the board have independent directors?

- How has the company performed in recent years – is there a steady performance over time for the company and/or the funds or investments you are considering?

Please Note: While past performance does not guarantee future returns, it can be an indicator as to times when a fund manager or investment provider has thrived; or alternatively an indication as to if they have held steady during more uncertain times – which may offer insight around how they respond to different market conditions.

RIPPL Effect reports (found on all funds within the Flint app) are a great place to start, to help with answering some of the questions you may have when conducting investment research.

Ping-pongs in perspective

If you do decide to invest, or have investments already with the likes of Flint, then Sorted advocate that you avoid any doomscrolling. They comment that “it’s such a bad idea to watch our investment balances ping-ponging up and down so often. The more we see ourselves seemingly lose money, the more chance we’ll pull the pin and explode our long-term progress.”

They advocate: “Long term, shares in general will continue to head upwards. But in the short term, we need to navigate a world of uncertainty by spreading our risk. Diversifying and regularly drip-feeding keeps us safe as we steadily grow our money.”

When it comes to growing your wealth, Sorted suggest: “Investing harnesses the power of compound interest over time. Starting early helps – the longer the timeframe, the more the value of investments can compound upwards and grow. Regularly adding to investments can greatly improve the results. If you regularly reinvest your returns {distributions or dividends} or constantly drip feed more money into your fund, you will see the highest growth.”

At Flint you may have heard us talk about drip feeding money into investments before, if this interests you check out our guide to Investing Windfalls.

And if you’re on the fence about investing, our ‘Playing the retirement guesstimation game’ article (available here) may be just the motivation you need to explore these planning tools further and dip your toe in the investment waters.

Happy investing!

Flint

Ps. When completing the investor profiling tools (available here) yourself you may find additional out-takes relevant to you. We’d love to hear what really resonates with you, so do reach out if you find something resonates or inspires you to invest.

IMPORTANT NOTICE AND DISCLAIMER:

All content shared is of a general nature, current to the time it was penned, and is not financial advice. Before making any investment decisions, please be sure you have completed full due diligence. This should include reading the product disclosure statement (PDS), considering fees and taxation, identifying your time horizons, and understanding the performance history and reputation of the investments you are considering.

Please note: When investing you are not guaranteed to make money (and on occasion you may lose some or all of the money you began with). Seek independent advice to establish if an investment is suitable for your financial situation and long-term wealth generation goals.

References:

https://sorted.org.nz/tools/investor-profiler

https://sorted.org.nz/guides/saving-and-investing/about-investing

https://sorted.org.nz/how-these-calculators-work