Greenwashing. An $80 trillion dollar debate.

Written: 20 September 2022

Author: Kirsty O’Hara

11 min read

‘ESG greenwashing’. We put these two words into Google’s search bar and it returned with “about 3,200,000” search results.

Obviously, we didn’t validate close to 3 million sites, however it’s clear to see this is a topic crossing many keyboards. No one wants to be hoodwinked by any misleading ‘green’ investments!

If you consider the fact that ESG (Environmental Social, and Governance) sits alongside Responsible Investing, Impact investing, Values-Based Investing, Ethical Investing and SRI (Socially Responsible Investing) - then there will likely be more than 3 million greenwashing queries in the land of google.

Before you get into a researching panic, let us share strategist Joel Makower’s insightful point:

‘If investors weren’t integrating ESG into their investment choices, then regulators and investors wouldn’t care about metrics or transparency. If there were no demand for ESG, there would be no greenwashing. Hence, a large enough segment of both individual and institutional investors - clearly not everyone, but definitely enough people - not only care about environmental impact and risk but are willing to put real money on it.’

Some people care so much about green investments actually being green, that organisations such as Mindful Money and The Responsible Investment Association of Australasia (RIAA) have been established. Their websites and certifications provide helpful guides and badges to educate consumers, and aim to provide greater transparency around the ethical composition and responsible philosophy of investments.

Their collaborative 2022 From Values to Riches study identified that 50% of investors surveyed were concerned about greenwashing; and 54% of participants were more likely to invest via an investment certified by a third party.

With a myriad of ‘environmentally friendly’ products out there – in the form of green bonds, green managed funds, sustainable equity financing, sustainability-linked bonds, carbon credits, ESG derivatives, and many more – the time to gain clarity around what defines ESG credibility is key.

Is ethical investing popular?

Reuters suggest that around $NZD1 trillion of investment funding flowed into global ESG funds in 2021, which was up 20 percent on the previous year.

Looking ahead, Bloomberg predict that total international ESG assets may exceed USD$41 trillion (NZD$65 trillion) in 2022; and by 2025 could reach $USD50 trillion ($NZD80 trillion).

Given the Financial Markets Authority (FMA) recently confirmed that 82% of New Zealanders over the age of 18 currently own some form of investment product, and the Values to Riches study discovered that 73% of investors expect their investments to be ethical or responsible, we can therefore make an educated assumption that close to 2 million kiwis may potentially be concerned about greenwashing.

With this level of interest, and dollars being pumped into investment products, it’s no surprise that the New Zealand Financial Markets Authority (FMA) did a report on the issue at the end of July. They looked for evidence, to see if investment offerings which claimed to be ethical could be substantiated, and found there was not enough evidence to back up the ethical statements in most cases.

The FMA are taking the line that “Providers must clearly explain and substantiate how [these products] are ethical,” and have flagged greenwashing as an area of interest - with further FMA reports in the pipeline.

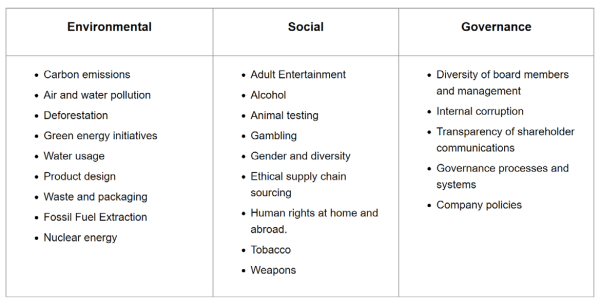

When thinking about ESG, the FMA share the following list of areas as a starting point, and highlight that ESG concerns are often interrelated and can exist across all three categories:

Source: Click here to visit the FMA website.

When did greenwashing begin?

Greenwashing was originally coined as a term back in 1986, by environmentalist Jay Westerveld. Jay wrote an essay claiming that hotels were falsely promoting environmental strategies, when they were in fact adopting cost saving measures such as encouraging guests to reuse towels (and therefore reducing service requirements).

The ‘greenwashing’ term is now used widely to acknowledge any organisation that is claiming to adopt environmental initiatives, when they are in fact motivated by a different metric. If an organisation is falsely promoting their environmental efforts, spending resources to appear more green, rather than engaging in sound environmental practices - then this deceptive information is considered greenwashing.

Barry Coates of Mindful Money states ““Greenwashing is basically where fund providers or companies are pretending to be more ethical than they actually are. Greenwashing is a form of exaggeration, it's a form of misleading advertising, it's a form of misrepresentation.”

Is there ESG greenwashing in New Zealand?

When it comes to new funds entering the market, we couldn’t help but note that more than half of the new managed funds launched in New Zealand in 2021/22 literally sport the word ‘sustainable’ in their title. This is likely prompted by consumer demand, with 73% of investors expecting their general investments to be invested ethically (according to the Mindful Money and RIAA From Values to Riches study). With climate driven investor sentiment on the rise, it is no surprise that fund managers are pivoting to provide investment products that appeal to ethical trends.

Coates confirms that ‘Greenwashing is not just an ‘elsewhere problem’ and champions the need for more regulation requiring investment providers evidence their ESG claims.

Should I be worried about greenwashing?

Unfortunately there is no easy way to answer this question. The short answer is, maybe. The longer answer requires you spend some time researching the integrity of investments you hold (or are considering holding).

Let’s compare two different investment frameworks - exclusion champions vs change agents:

A simple analogy, to explain a change agent (long-game) strategy, could be to look at consumer options when choosing almond butter at the supermarket. Imagine you are shopping, and you have three choices – you can choose:

- Standard ‘Almond Butter’

- ‘Organic Almond Butter’

- Or ‘Almond Butter in Conversion’

If you are yet to pick up a jar of ‘Almond Butter in Conversion’ - then this is how Ceres explain it:

“These crushed almonds are undergoing a transformation, we think it’s magical. Their caring farmers are converting their farms to organic which is a time-consuming, costly job but so worth it in the long run. Choosing this jar means you’re supporting farmers through this transition period. We’re nuts about helping to grow more organic agriculture in the world!”

If we wear a similar change agent hat and consider Research IP’s report Beneath the Surface of Responsible Investing we can see the ‘Almonds in Conversion’ and any ‘Fossil Fuels in Conversion’ might well be framework cousins. Research IP comment:

“A great example of the [fossil fuel] transition is the Danish company Ørsted. It was once one of the most coal-intensive energy companies in Europe. Today, they claim to be the world’s most sustainable energy company, and a global leader in the transition to green energy. This is arguably where capital should be directed, but appeared on many exclusion lists.”

Beware nuisances and nuance

Investment adviser Chelsea Traver, of Evergreen Advice, makes the comment that even with research “it still can be hard to tell if a fund invests according to your values or not. Responsible investing has a lot of nuisances to it and subjective judgements need to be made”.

She highlights her point by referencing the contradiction of Tesla, the darling child of ethical fund managers, who have recently been sued for alleged discrimination against Black employees. Traver asks: “Does it [Tesla] belong in an ethical fund? Does its importance in helping to fight climate change make up for the fact that it scores more poorly on social and governance issues?”

She also references ethical funds who intentionally exclude nuclear power, and suggests that despite the fact that some ESG funds exclude investing in fossil fuels, that funding nuclear power (as we discussed above) could help move the planet away from a reliance on fossil fuels.

Traver states “It’s this nuance that makes investing responsibly difficult and why it’s so important to ensure your ethical investments have a clear methodology and a process for updating it based on new criteria and controversies. While there is no easy checklist to identify greenwashing, by doing some digging you can better understand how ethical your investments actually are”.

What can I do to avoid greenwashing?

You’ve probably heard the saying, ‘vote with your dollars’. The easiest way to do this is to choose funds that have a certification by a third party, validating their funds as ‘green’; or otherwise do your own research and ensure that you have a clear handle on the responsible investing framework of a particular investment provider.

When you look at funds sporting a RIAA (Responsible Investment Association of Australasia) badge - you know that these funds have had to pass certain criteria and assessment to earn that badge. When fund managers begin working with RIAA it can take up to three years to validate the sustainable qualities of that fund. The RIAA framework is a third party certification, and follows a robust framework that has the respect of the industry. On Flint you’ll spot a RIAA filter, and RIAA badges, to easily identify these certified funds. We’ve written more about RIAA on another article (available here).

As we touched on above, another way to avoid greenwashing, is to look for funds that best fit a certain set of exclusions. Mindful Money offer a mix of investment selection search tools, and exclusion badges, to help investors make more informed decisions. When you visit the Mindful Money website you can rank how important each of the exclusion issues are to you - and the checker tool will guide you towards investments that meet your exclusion criteria. Investment providers can also gain Mindful Money certification, with badges for certain exclusions (such as weapons, fossil fuels, animal testing, etc).

If accolades are your jam, Mindful Money have also recently launched annual awards - where funds are assessed for their ethical merits and framework. We have written about the Mindful Money awards here and here. Check them out.

To avoid greenwashing definitely check out RIAA and Mindful Money as part of your research process.

What else can I do to avoid being hoodwinked?

Law firm Chapman Tripp make a great point, suggesting “The fundamental problem is the absence of agreed terms and definitions,” and continues on to state, “the temptation this creates is to resort to puffery in order to avoid potential legal liability. To its credit, the industry is working actively and collectively to address this through the development of clear taxonomies and certification programs.”

If you want to see beyond the puffery, Chapman Tripp has five key messages to fund managers, which retail investors can also watch out for in upcoming product disclosure statements and marketing collateral. Based on this we should expect to see fund managers:

- Explain exclusions. Setting out why the fund has excluded particular companies and sectors, and how exclusions will be applied in the future;

- Be clear about the relevance and weight of financial and non-financial factors in decision-making and the risks that come from including non-financial factors;

- Set out how you will select investments for your ESG funds;

- Don’t rely in ‘high-level’ and amorphous claims of non-financial benefits and impacts; and

- Explain how you will measure performance and deal with investments that no longer meet the original criteria for selection into ESG funds.

Give it time

Coates, of Mindful Money, said that lots of funds are on a journey to becoming ethical. New Zealand is not better or worse than any other country when it comes to greenwashing. He also points out that we need pools of capital to be able to invest in the climate transition.

Deloitte echo a similar sentiment, stating “sustainable investment is vital to our future and to combat climate change. This points to the need for more sophisticated analyses and higher demands on data integrity -- the opposite of the current “green-rush” into investments claiming ESG credentials.”

Can I make money with green investments?

A valid question from retail investors is ‘can I invest to my values and still make money?’

As always, we have to say that past performance does not guarantee future returns.

The literature to date shows that you can invest to your values, and still make good returns. That said, it will be interesting to see the next chapter of ESG regulation unfold and observe how evidence-based practice plays out across the marketplace.

When investing always make sure to research the investments you are considering (green or not) – and only invest money you can afford to part with.

Which funds on Flint should I check out?

While we can’t give advice, we have written FLINTroductions – to help you get to know the fund managers on Flint. Four of the award winning managers we have on Flint that promote a heavy focus on ESG frameworks include:

- Pathfinder – FLINTroduction available here (1 RIAA certified fund on Flint)

- Harbour – FLINTroduction available here (3 RIAA certified funds on Flint)

- Devon – FLINTroduction available here (Mindful Money award winner)

- Tahito – FLINTroduction available here (Mindful Money awards finalist)

Each of their FLINTroduction’s speaks to the general offerings each fund manager has, and touches on ESG frameworks important to each fund manager. Please note: not every fund held by these fund managers has ESG certification. If in doubt, look for RIAA badges in the Flint app – and always read the PDS when conducting your investment research.

In Conclusion

If you are really worried about greenwashing, and don’t have the time to research it - then you can always consult an adviser who specialises in that area of investing. Alternatively, look to RIAA and Mindful Money for certified funds, to help fast track your decision making with confidence.

While some people may be concerned about ‘being greenwashed’, and find this anxiety stifles their enthusiasm for investing, it’s important to point out that there are potential benefits when we do invest money into products with robust ESG frameworks. When investing ethically we are effectively putting that money to work to not only generate returns – but also to work towards optimal ESG outcomes and climate transformation initiatives.

Many reputable fund managers have been championing the need for transparency for years, well before ethical and sustainable investing became mainstream. By selectively choosing investment providers that will go in to ‘bat’ and ensure our money works hard to generate returns, as well as support a thriving ecosystem, we can be thankful that greenwashing is a topic of healthy debate and regulatory assessment.

Like many things in life, ESG investing needs to be a win, win, win. A win for the investor, a win for the investment provider, and a win for the planet.

Happy green investing!

Flint

IMPORTANT NOTICE AND DISCLAIMER:

All content shared is of a general nature, current to the time it was penned, and is not financial advice. Before making any investment decisions, please be sure you have completed full due diligence. This should include reading the product disclosure statement (PDS), considering fees and taxation, identifying your time horizons, and understanding the performance history and reputation of the investments you are considering.

Please note: When investing you are not guaranteed to make money (and on occasion you may lose some or all of the money you began with). Seek independent advice to establish if an investment is suitable for your financial situation and long-term wealth generation goals.

Sources (click for links):

FMA Good Returns ; FMA Good Returns 02 ; FMA Business Desk ; FMA Stuff article ; FMA Disclosure Framework ; FMA Investor Confidence Survey; FMA ethical investing ; Newsroom Money & Greenwashing ; Values to Riches Study ; Mindful Money Checker ; interest.co.nz ; Research IP ; Orsted ; KPMG on Greenwashing ; PWC on Greenwashing ; Deloitte on Greenwashing ; Evergreen Advice Chelsea Traver ; Greenbiz ; Jay Westerveld ; Pathfinder ; North & South ; Harbour Article